Euro pulls back in last week of CFTC data

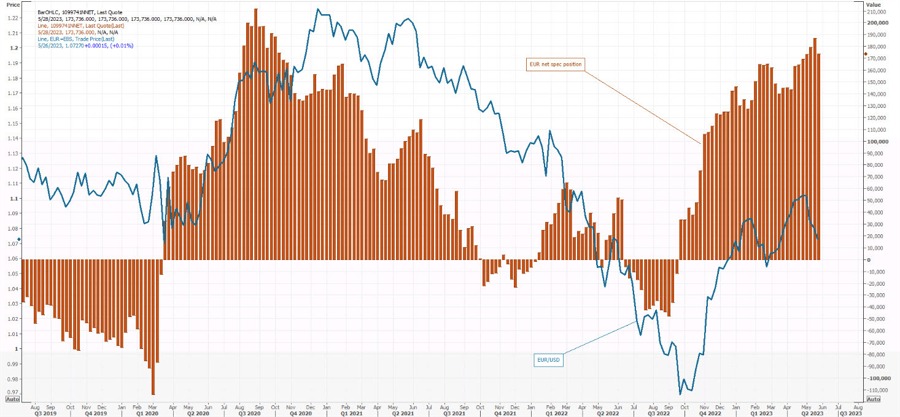

The speculative market remains too long for the euro, but in the last week CFTC data has taken back the position, which could be an indication of what’s to come.

The EUR’s net speculative long position witnessed a significant decline, falling from 187,089 contracts to 173,736 contracts in the previous week. While traders appear to have cut their bullish forecasts, this change shows some caution seeping into market sentiment regarding the euro’s performance.

The Japanese yen saw a significant increase in short positions and reached 80,660, a notable increase from 64,791 before. This marks an increasing bearish sentiment on the yen among traders. Similarly, AUD cut its short position to 49,081, a slight relief from 54,594 in the previous week.

By contrast, the long position of the British pound fell marginally from 12,593 to 11,589.

The Swiss Franc saw its small short position halve to 903 from 1,859 the previous week, marking a potential shift in traders’ sentiment towards a less bearish outlook.

In the net week’s data, I expect to see more signs of US dollar buying as the dollar rises, inflation soars and the debt ceiling fiasco draws to a close. The euro is particularly vulnerable given the size of its net position.