Dollar down but not out yet as CPI expected

At this point, the euro is the strongest of the week so far while the Swiss franc is the weakest thanks to the upside breakout and yesterday’s rally. The dollar is also on the soft side, but there is still no clear follow-up selling after Monday’s decline. It seems traders are still holding their bets awaiting today’s US consumer inflation data. Significant deceleration in both headline and core CPI is expected, which should signal a smaller 25 basis point rate hike by the Fed in February.

Technically 1.1574 correction pattern following GBP/CHF should have completed after yesterday’s 3 wave surge to 1.1094. Further recovery is now expected as long as 1.1180 support holds. Should see a retest of 1.1543/74 resistance zone next. As EURGBP struggles to firmly break the 0.8876 resistance, the current moves from the European majors are more about the Swiss Franc’s own weakness.

In Asia, the Nikkei is up 0.05% at the time of writing. The Hong Kong HSI is down -0.30%. China Shanghai SSE is down -0.16%. The Singapore Strait Times is down -0.45%. The Japanese 10-year JGB yield is up 0.0039 to 0.510. Overnight, the DOW rose 0.80%. The S&P 500 rose 1.28%. NASDAQ rose 1.76%. The 10-year yield fell -0.067 to 3.554.

Fed Collins: I would bet 25 for the February meeting

Boston Fed President Susan Collins said in an interview with The New York Times that “25 or 50 is reasonable” for a February rate hike. She added, “I would bet 25 at this point, but it’s very data dependent.”

“Slow adjustment gives more time to evaluate the incoming data before making a decision as we near our goal. Minor changes give us more flexibility,” she said.

ECB de Cos: We plan to raise interest rates significantly in the next few meetings

ECB Governing Council member Pablo Hernandez De Cos said yesterday: “We plan to hike interest rates further significantly at the next meetings.” In addition, tightening will continue “until a sufficiently restrictive level is reached to ensure that inflation is on target over the medium term.” of 2% returns”.

“Keeping interest rates low will reduce inflation by dampening demand and will also protect against the risk of a sustained upward movement in inflation expectations,” he said.

De Cos also noted that since the last meeting, markets have upgraded the expected final rate by 30 basis points to 3.4%. However, market interest rates contain a positive premium and “the market’s true expectation for the maximum level of the deposit facility rate is slightly below this number.”

On the data front

New Zealand building permits rose 7.0% mom in November. Australia’s trade surplus widened to A$13.2 billion in November, beating expectations of A$11.3 billion. Japanese bank lending rose 2.7% yoy in December, with the current account reporting a surplus of JPY1.92k in November. China’s CPI rose to 1.8% yoy in December, while the PPI rose to -0.7% yoy.

Looking ahead, today’s focus will be on US CPI while also posting jobless claims.

EUR/USD daily outlook

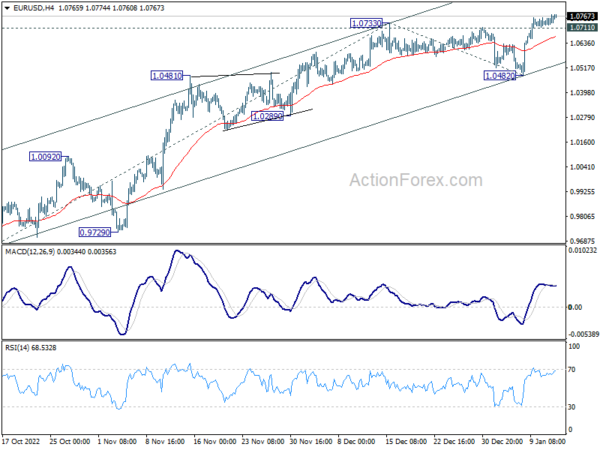

Daily Pivots: (S1) 1.0730; (P) 1.0753; (R1) 1.0780; More…

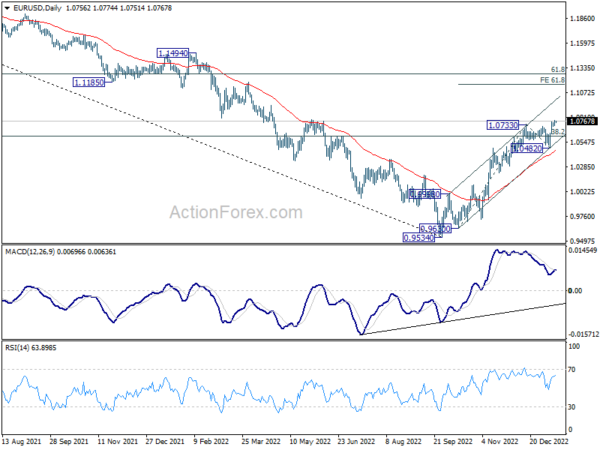

The intraday bias in EUR/USD remains upside despite some loss of upside momentum. Current rally 0.9534 would target 61.8% view 0.9630 – 1.0733 from 1.0482 at 1.1164. On the downside, minor support below 1.0711 will initially neutralize intraday bias again. But near-term outlook remains bullish as long as 1.0482 support holds in case of a pullback.

Overall picture focus remains on the 38.2% retracement from 1.2348 (2021 high) to 0.9534 at 1.0609. A rejection at 1.0609 suggests that price action could develop into a corrective pattern from 0.9534, the medium-term floor. Thus, a mid-range bearish hold for further decline to 0.9534 at a later date. However, a sustained break of 1.0609 increases the likelihood of a trend reversal and targets a 61.8% retracement at 1.1273.

Update of economic indicators

| Greenwich Mean Time | Ccy | events | Indeed | forecast | previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | CHF | Building permits M/M Nov | 7.00% | -10.70% | ||

| 11:50 p.m | JPY | Bank Loans Y/Y Dec | 2.70% | 2.80% | 2.70% | |

| 11:50 p.m | JPY | Checking Account (JPY) Nov | 1.92T | 0.65T | -0.61T | |

| 00:30 | CHF | Trade Balance (AUD) Nov | 13.20B | 11:30 a.m | 12.22B | 12.74B |

| 01:30 | CNY | CPI Y/Y Dec | 1.80% | 1.80% | 1.60% | |

| 01:30 | CNY | PPI Y/Y Dec | -0.70% | -0.10% | -1.30% | |

| 05:00 | JPY | Eco Watchers Survey: Current Dec | 47.9 | 47.8 | 48.1 | |

| 09:00 | EUR | ECB economic report | ||||

| 1:30 p.m | USD | Initial Jobless Claims (January 6) | 210,000 | 204K | ||

| 1:30 p.m | USD | CPI M/M Dec | 0.00% | 0.10% | ||

| 1:30 p.m | USD | CPI Y/Y Dec | 6.50% | 7.10% | ||

| 1:30 p.m | USD | CPI Core M/M Dec | 0.30% | 0.20% | ||

| 1:30 p.m | USD | CPI Core Y/Y Dec | 5.70% | 6.00% | ||

| 15:30 | USD | natural gas storage | -15B | -221B |