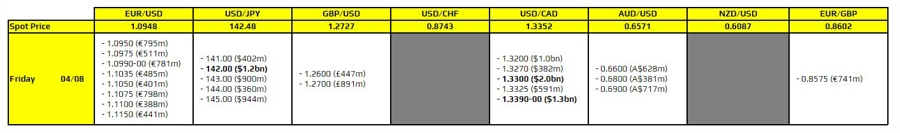

Currency option expires August 4 at 10:00 am New York discount

As highlighted below, there are a couple of things to note per day. intrepid.

The first is at 142.00 for USD/JPY, a level that buyers can try to resist in case of any downside push. The figure level has some technical significance in reaffirming Monday’s break, so futures could add to a layer of defense before rolling out later today.

Then there are some big ones at 1.3300 and 1.3390-00 for USD/CAD. The former isn’t of much technical significance, but it could be a point of contention if we later see some bearish pressure on the pair after the mix of Canadian and US jobs reports. Meanwhile, the latter 100-day moving average is seen at 1.3400, so it can act as an additional layer of defense for sellers in keeping price action steady.

However, much will mostly depend on the US jobs report and how that will affect dollar sentiment. At most, expirations will help keep price action within ranges before it hits the main event. What happens next is subject to what we can see from the data, but if there are no major surprises, then the above consideration of expiry times is something to consider when viewing price action.

For more information on how to use this data, you can refer to this post here.