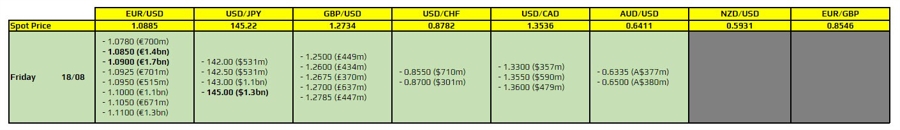

Currency option expires August 18 at 10:00 am New York discount

As highlighted below, there are a couple of things to note per day. intrepid.

The first is for EUR/USD at 1.0850 and 1.0900. These look like they will keep the price action in more control in the session before taking action later today. This, with the 100-day moving average at 1.0930, continues to keep the interest of the sellers alive as the bearish momentum continues.

Then there is what could come at 145.00 as a support layer for USD/JPY and/or perhaps an anchor for price action. The point today is that we’re seeing a significant drop in bond yields and so there’s currently a pull towards the figure level. Buyers will try to defend this to continue the upward move, so futures could play a role in helping this. But I would like to warn you that bond market sentiment is much, much more important in this case.

For more information on how to use this data, you can refer to this post here.