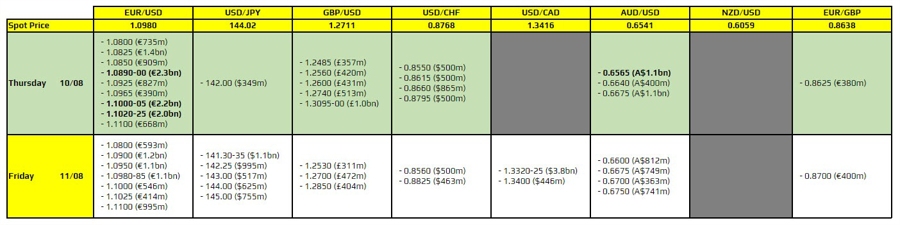

Currency option expires August 10 at 10:00 am New York discount

As highlighted below, there are quite a few to note for the day. intrepid.

The big ones are near 1.0900 and 1.1000 and just above that for EUR/USD. Futures around 1.1000-25 are likely to keep any upside in check before starting the day, but beware as the US CPI report will also have a significant impact on price action.

As for those close to 1.0900, they are not associated with any technical meaning, as the 100-day moving average for the pair is the most important downside to watch. This is currently seen at 1.0926. However, later on, in response to the main event, expirations may move with figure-level offers to keep price action more limited.

Aside from that, there are those for AUD/USD at 0.6565, which are currently between the 100 and 200 hourly moving averages, 0.6553-83. However, I don’t think expiration plays a very prominent role in dictating price action as traders will be more responsive to the US CPI report and the relevant near-term levels above. As for the downside, the daily support at 0.6500 is the most important at the moment.

For more information on how to use this data, you can refer to this post here.