Germany is in crisis, but the DAX is not slowing down. Here’s Goldman Sachs’ view

There Germanyknown for its robust economy and its role as a driving force behind the European Union amid numerous “headwinds” that continue to weaken its economy. To emphasize it Goldman Sachs in the report “German stocks, the performance puzzle” in which he talks about the recession.

In the words of Peter OppenheimerChief global equity strategist and head of EMEA macro research at Goldman Sachs, the difficult situation the economy is currently in is due to several factors: challenges in manufacturing, a slow recovery in China and rising energy costs contributed to the recession.

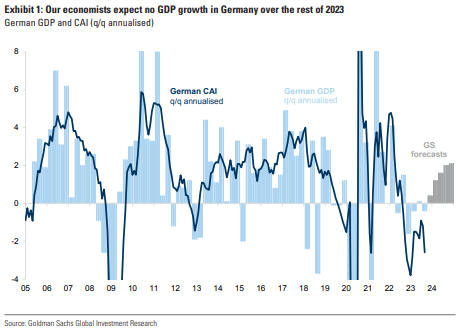

Oppenheimer emphasized that despite this situation, it was not a deep recession, but was primarily influenced by a few factors. In detail, the economists at the US investment bank do not expect German GDP to grow for the rest of 2023 (-0.6% in the third quarter, -0.1% in the fourth quarter), but assume the rate will accelerate by 1%. out of. Next year.

Dax still in the race, +13% Ytd

“Despite sluggish economic growth The Dax has grown by 13% since the beginning of the year, outperforming the European market and its earnings have been revised upwards“Basically, things didn’t go as badly as feared, so the markets reassessed the risks surrounding Germany: The DAX grew by 30 percent compared to the previous year’s low,” emphasize the experts at Goldman Sachs.

This is what the Bundesbank says: Dependence on China and weak supply chains

These opinions reflect the latest forecasts from Bundesbankwhich has estimated in recent days that the German economy is likely to shrink this quarter due to slowing private consumption and difficulties in industry.

One of the most obvious problems for the German economy is its growing dependence on China, with 29% of Germanic companies importing vital materials and parts from the Asian country. In 2022, China has become the main source of imports for German companies, supplying a significant proportion of important raw materials such as rare earths, lithium and cobalt. This dependence has created significant vulnerability for the German economyas a sudden break with China could lead to widespread disruption to supply chains and production in the short term.

To address this challenge, economists suggest greater diversification of suppliers in international trade. Promoting regional free trade agreements could reduce dependence on China and prevent potential supply chain crises.

Increase in energy costs and impact on the manufacturing sector

Another factor that is putting pressure on the German economy is:rising energy costs. After the war between Russia and Ukraine, gas deliveries from Russia fell, which led to a significant increase in energy prices in Germany. Also in the coming years Energy prices are expected to remain high compared to the period before the crisis in Ukraine escalated.

Thanks to its good earnings and financing situation, German industry was able to effectively cushion the energy price shock. However, there were serious disruptions in some sectors, particularly energy-intensive industries such as the chemical and paper industries and the production of base metals. Many of them have responded to rising energy prices with adjustments such as energy savings or increases in sales prices. In addition, many companies are investing more in energy efficiency and the use of renewable energies.

Despite these efforts Goldman Sachs warns that rising energy costs could still slow trending German GDP growthwhich endangers the country’s economic prosperity.

Transition to a zero-emissions economy

Germany has set itself the ambitious goal of becoming a climate-neutral country by 2050. However, this transition requires major investments in renewable energy and coherent energy and climate policies. In the Bundesbank’s view, it is essential to mobilize significant private investments to finance the green transition in order to give companies the necessary planning security and reduce the overall economic costs of decarbonization.

Jens UlbrichChief Economist of the Bundesbank, emphasized the need to accelerate investments in renewable energies and simplify legal processes to ensure the success of the energy transition.

Demographic change and limited labor supply

Demographic change represents another major challenge. The aging population and the decline in the number of working-age people are putting pressure on labor supply and intensifying the competition for skilled workers. The Bundesbank warns that immigration alone may not be enough to offset the decline in labor supply.

The federal government has launched plans to supplement the Skilled Immigration Act of 2020, but additional efforts need to be made to ensure an adequate supply of workers. These efforts could include the expansion of the EU Blue Card for highly qualified workers, the rapid integration of immigrants into the labor market, and improvements to childcare facilities and early retirement schemes.

Opportunities in digitalization

Despite the challenges, the Bundesbank experts believe the German economy remains well positioned. Digitalization offers significant opportunities for economic growthwith digital sectors proving to be key drivers of overall productivity over the past few decades.

To fully exploit the potential of digitalization, Germany must invest in a more efficient digital infrastructure and improve the training of digital skills in both the workforce and the education system.