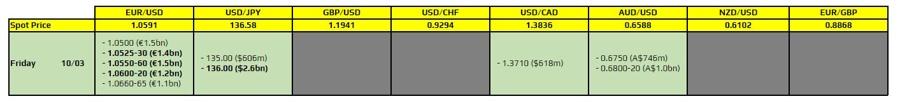

Currency option expires March 10 at 10:00 am New York discount

As highlighted, there is a couple to note. intrepid.

The first is a series of expirations for EUR/USD from 1.0525 (or even 1.0500) to 1.0620, which is likely to play a role in limiting price action around current spot levels ahead of the US jobs report later today. . On the downside, the 100-day moving average at 1.0532 would be an important technical level to add to the aforementioned maturities layer.

Then there’s USD/JPY at 136.00, which is now near its 100-day moving average at 135.99. This will add some layer of defense before rolling out later in the day. For now, the pair is holding higher after the BOJ policy decision, but amid the sharp decline in Treasury bond yields, there may be some work to be done.

For more information on how to use this data, you can refer to this post here.