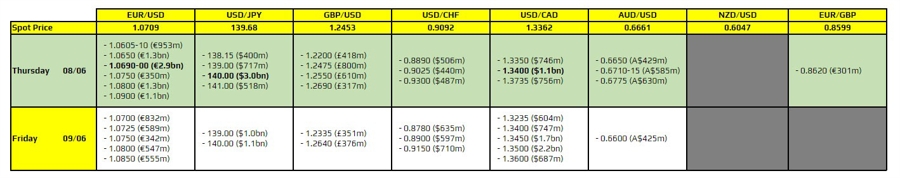

Currency option expires June 8 at 10:00 am New York discount

There are a few big ones to consider, as highlighted intrepid.

The first is for EUR/USD and is near the 1.0700 mark. As such, it could act as an anchor for price action or at least prevent it from getting too far down before it rolls out later today. If you need a reason to think the pair won’t do much today, that’s about 3 billion euros worth of reason to wait.

The next big one is at 140.00 for USD/JPY and there is a significantly large maturity set here. The pair is currently trading below the figure level and is currently holding the 100 and 200 hourly moving averages in the 139.64-72 region. If anything else, expect the above times to limit the price action that will come tomorrow as well.

And finally, there is a pretty big level at 1.3400 for USD/CAD. This could move alongside the 100 hourly moving average, which is currently at 1.3413, to keep any upside momentum at bay throughout the day. But for the pair itself, the tech shows that sellers are regaining control after testing the key trendline support once again yesterday:

USD/CAD daily chart

For more information on how to use this data, you can refer to this post here.